.jpeg)

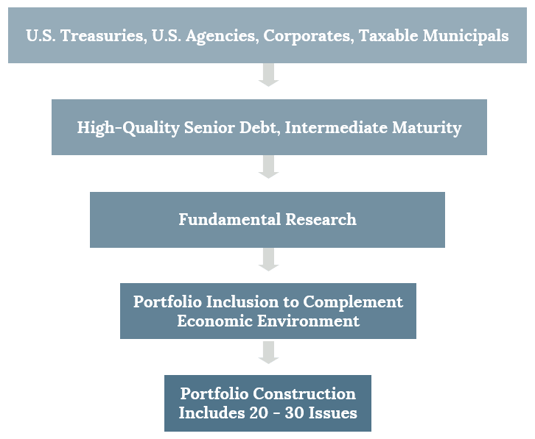

The goal of our investment process is to identify high-quality, intermediate maturity bonds from the U.S. Treasury, U.S. Government Agency, Taxable Municipal, and Corporate bond sectors with above-average relative value characteristics.

Learn more about our approach by accessing our Investor Presentation:

Our firm's greatest assets are our people. Our dedicated and capable team is committed to client success and client satisfaction, with consistency and quality. The firm’s dedication to integrity, best-in-class asset management, client service, and the culture of collaboration and professional dedication augurs well for a bright future for the firm, its professionals, and its clients.

Learn more about the Crawford Team:

Portfolio Manager

Jonathan R. Morgan is a Portfolio Manager at Crawford Investment Counsel and has been with the firm since 2006. Jon is also a Principal of the Firm. Jon leads the Fixed Income Policy Team and oversees all areas of operations, portfolio management and trading in the fixed income department. He also serves on the Senior Leadership Team. Prior to joining Crawford Investment Counsel, Jon was a Principal of MPM, Inc., a municipal bond investment firm in Atlanta.

Jon received his BS in Finance and Economics from Miami University Oxford, Ohio.

Fixed Income Portfolio Manager

Leslie M. Krone is a Portfolio Manager at Crawford Investment Counsel and has been with the firm since 2005. Leslie is responsible for fixed income research, trading and portfolio management across all fixed income strategies. She is a member of the Fixed Income Policy Team. Prior to joining Crawford Investment Counsel, Leslie was an Associate in Fixed Income trading at Trusco Capital Management and Assistant Vice President in Municipal Bond trading at SunTrust Bank.

Leslie received her BS in Finance with a minor in Management from The University of Dayton.

Managing Director of Fixed Income Investments

Geoffrey S. DeLong, CFA is the Managing Director of Fixed Income Investments at Crawford Investment Counsel and has been with the firm since 2008. Geoff is responsible for fixed income research, trading and portfolio management across all fixed income strategies. He serves on the Fixed Income Policy Team. Prior to joining Crawford Investment Counsel, Geoff was a Director at SunTrust Robinson Humphrey.

Geoff received his BA in Finance from Wofford College and MBA from the University of South Carolina. He has earned the Chartered Financial Analyst (CFA) designation.

Sales

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Fusce iaculis bibendum ipsum, volutpat blandit mi vulputate ut. Nunc nunc elit, ultrices et risus quis, aliquam congue magna. Vivamus vulputate lacinia felis vitae ultrices.

Nunc sapien ante, euismod finibus augue iaculis, feugiat tempus nulla. Aliquam erat volutpat. Vestibulum nec dolor condimentum, congue velit ut, molestie eros. Donec facilisis porttitor orci, a fringilla orci mattis eu. Donec blandit est at volutpat sagittis.

Creative

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Marketing

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Aliquam mi nibh, consequat ut commodo ut, egestas fringilla tellus. Proin enim tellus, maximus eget quam sit amet, pulvinar blandit massa. Mauris in felis posuere odio dignissim auctor eget ac augue. Donec elementum neque in metus viverra fermentum. Maecenas porttitor pharetra diam, nec dictum tortor placerat nec. Nunc sit amet rutrum purus. Suspendisse fringilla dui risus, in vulputate leo consequat vel. Nam eu lorem lectus.

Security

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Fusce iaculis bibendum ipsum, volutpat blandit mi vulputate ut. Nunc nunc elit, ultrices et risus quis, aliquam congue magna. Vivamus vulputate lacinia felis vitae ultrices.

Nunc sapien ante, euismod finibus augue iaculis, feugiat tempus nulla. Aliquam erat volutpat. Vestibulum nec dolor condimentum, congue velit ut, molestie eros. Donec facilisis porttitor orci, a fringilla orci mattis eu. Donec blandit est at volutpat sagittis.

Sales

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Aliquam mi nibh, consequat ut commodo ut, egestas fringilla tellus. Proin enim tellus, maximus eget quam sit amet, pulvinar blandit massa. Mauris in felis posuere odio dignissim auctor eget ac augue.

Donec elementum neque in metus viverra fermentum. Maecenas porttitor pharetra diam, nec dictum tortor placerat nec. Nunc sit amet rutrum purus. Suspendisse fringilla dui risus, in vulputate leo consequat vel. Nam eu lorem lectus.

Finance

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Fusce iaculis bibendum ipsum, volutpat blandit mi vulputate ut. Nunc nunc elit, ultrices et risus quis, aliquam congue magna. Vivamus vulputate lacinia felis vitae ultrices.

Nunc sapien ante, euismod finibus augue iaculis, feugiat tempus nulla. Aliquam erat volutpat. Vestibulum nec dolor condimentum, congue velit ut, molestie eros. Donec facilisis porttitor orci, a fringilla orci mattis eu. Donec blandit est at volutpat sagittis.

Content

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Aliquam mi nibh, consequat ut commodo ut, egestas fringilla tellus. Proin enim tellus, maximus eget quam sit amet, pulvinar blandit massa. Mauris in felis posuere odio dignissim auctor eget ac augue. Donec elementum neque in metus viverra fermentum. Maecenas porttitor pharetra diam, nec dictum tortor placerat nec. Nunc sit amet rutrum purus. Suspendisse fringilla dui risus, in vulputate leo consequat vel. Nam eu lorem lectus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

Product

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla tincidunt arcu quis magna varius sagittis. Donec ac neque eleifend lorem feugiat laoreet. Vestibulum auctor vel dui quis vehicula. Aenean placerat molestie velit a tristique.

Proin pharetra erat ac varius placerat. Aliquam convallis feugiat nisl, eu eleifend ipsum ultrices dictum. Etiam convallis nisi eu justo laoreet, sed rhoncus neque placerat. Phasellus lacus velit, fermentum eget lacus id, suscipit eleifend risus.

600 Galleria Parkway

Suite 1650

Atlanta, Georgia 30339

Main: 770.859.0045

Fax: 770.859.0049

Email: info@crawfordinvestment.com

Copyright © 2021 | Crawford Investment Counsel, Inc. | All Rights Reserved.

Crawford Investment Counsel, Inc. (“Crawford”) is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Crawford Investment Counsel, including our investment strategies, fees and objectives, can be found in our Form ADV Part 2A and our Form CRS.

Web Site Development by: Goodwood Consulting

You are now leaving the Crawford Investment Counsel website and accessing the

Crawford Investment Funds website.

To help us personalize the site to your needs,

please select one of the following that best describes you.

You are now entering the area of the Crawford Investment Counsel website

that is for Consultant & Investment Professional Use Only.

You are now leaving the Crawford Investment Funds website and accessing the

Ultimus Fund Solutions website.

You are now entering the area of the Crawford Investment Counsel website

that is for Endowment & Foundation Use Only.