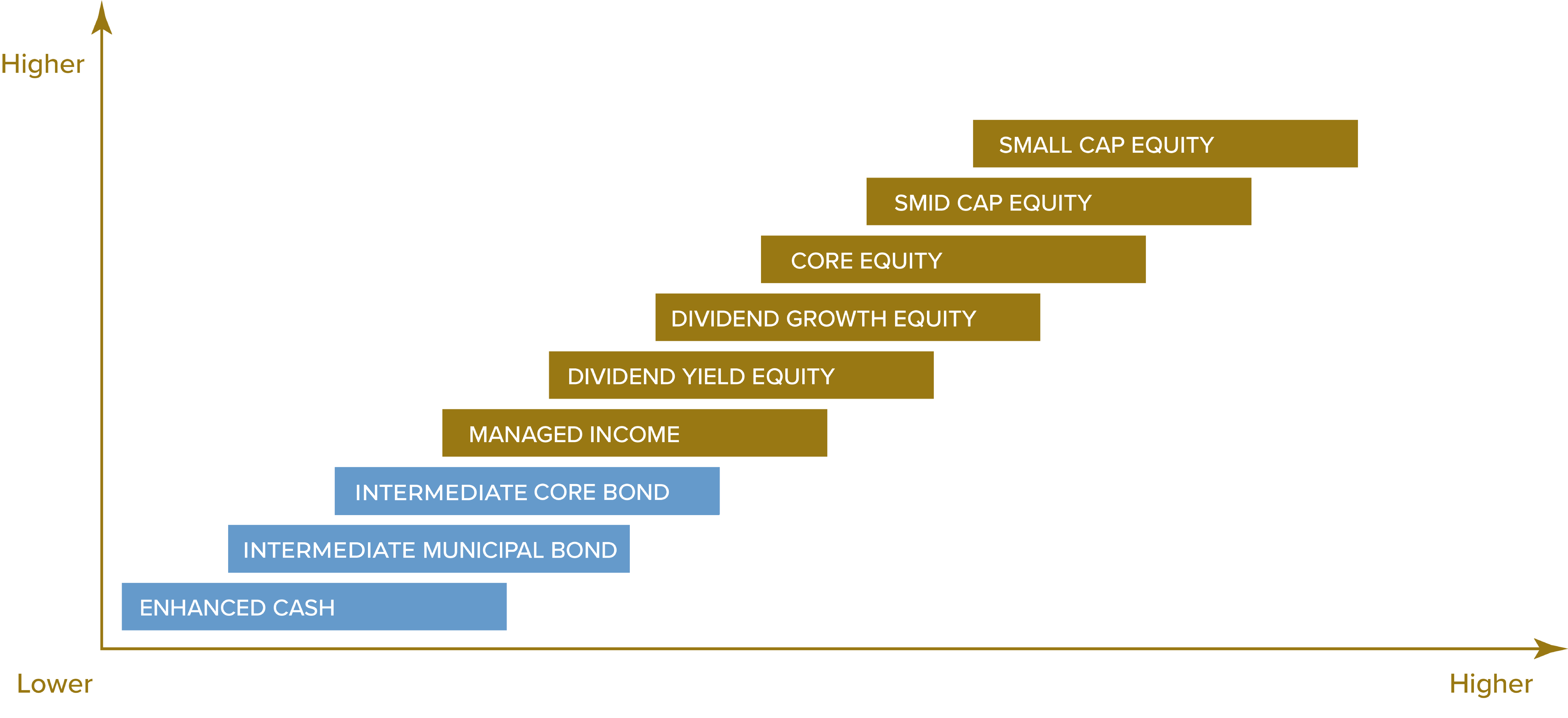

The Small Cap strategy seeks total return in a less efficient area of the stock market while attempting to exploit a behavioral bias amongst investors. In the small cap space, we believe there are strong opportunities for price sensitive investors in high-quality, dividend-paying companies that demonstrate consistency in their business

The SMID Cap Equity strategy approach is long term, total investment return oriented, and seeks to provide a high and growing stream of dividend income. A thorough, bottom up investment research process and adequate diversification are priorities. The stock selection criteria are focused on total return, expected contribution to portfolio yield, and quality. In this portfolio, quality implies both safety of the dividend and predictability around total investment return potential, among others. We seek to position the portfolio at the intersection of higher quality and higher-yielding stocks.

| Inception: 11/1/2012 Style: Small/Mid Cap Value |

Representative Holdings |

|

|

| Inception: 11/1/2012 Style: Small/Mid Cap Value |

|

|

|

|

The Core Equity strategy is a “best ideas” total investment return portfolio of dividend-paying companies. We use a bottom up, fundamental investment approach focused on high-quality stocks. Portfolio holdings are primarily based on individual research analyst conviction levels (“best ideas”). The result is a portfolio of consistent businesses from across the capitalization spectrum that have a catalyst for future price appreciation.

| Inception: 1/1/2000 Style: All-Cap Blend/Core |

Representative Holdings |

|

|

| Inception 1/1/2000 Style: All-Cap Blend/Core |

|

|

|

|

The Dividend Growth Equity strategy is a long-term, value-oriented investment approach that seeks an attractive combination of above average dividend yield and above average dividend growth. In- depth, fundamental research is conducted on new and existing holdings. This high-quality bias and propensity to pay increased dividends helps us achieve our objectives of attractive, risk-adjusted total return, income, and growth of income.

| Inception: 1/1/1981 Style: Large Cap Value |

Representative Holdings |

|

|

| Inception: 1/1/1981 Style: Large Cap Value |

|

|

|

|

The Dividend Yield Equity strategy approach is long term, total investment return oriented, and seeks to provide a high and growing stream of dividend income. A thorough, bottom up investment research process and adequate diversification are priorities. The stock selection criteria are focused on total return, expected contribution to portfolio yield, and quality. In this portfolio, quality implies both safety of the dividend and predictability around total investment return potential, among others. We seek to position the portfolio at the intersection of higher quality and higher yielding stocks.

| Inception: 10/1/2010 Style: Large Cap Value |

Representative Holdings |

|

|

| Inception: 10/1/2010 Style: Large Cap Value |

|

|

|

|

The Managed Income portfolio’s primary objective is current yield. This is achieved by owning common and preferred stocks, Real Estate Investment Trusts (REITs), and energy infrastructure companies, among other securities (including fixed-income investments). All securities are publicly traded and there are no K-1s. Investment decisions are based on fundamental research.

| Inception: 11/1/2012 Style: Multi-Asset Income |

Representative Holdings |

|

|

| Inception: 11/1/2012 Style: Multi-Asset Income |

|

|

|

|

The Intermediate Core Bond investment strategy is focused on the objectives of capital preservation and income production. We seek to maximize portfolio income while minimizing credit, interest rate, and reinvestment risk. Securities in the U.S. Treasury, government agency, corporate, and taxable municipal sectors are considered for inclusion. Portfolios are structured using a laddered maturity distribution, and typically consist of 20 to 30 securities invested across an intermediate time horizon.

The Intermediate Municipal Bond strategy concentrates on high quality, intermediate maturity municipal bonds from the national marketplace. Crawford selects individual securities to create a portfolio to meet the specific needs of each client. Crawford invests the portfolio to produce above-market yields, the dominant contributor to total return in the municipal market. Through the extensive research process, Crawford identifies specific sectors and structures that are expected to produce higher-than-market yields over time.

The Enhanced Cash Strategy concentrates on high-quality, short-term municipal bonds. The strategy provides an alternative to tax exempt money market funds. The portfolio utilizes above-market-rate-coupon municipal bonds with short-term redemption features in order to enhance the overall yield available from short duration bonds.

600 Galleria Parkway

Suite 1650

Atlanta, Georgia 30339

Main: 770.859.0045

Fax: 770.859.0049

Email: info@crawfordinvestment.com

Copyright © | Crawford Investment Counsel, Inc. | All Rights Reserved.

Crawford Investment Counsel, Inc. (“Crawford”) is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Crawford Investment Counsel, including our investment strategies, fees and objectives, can be found in our Form ADV Part 2A and our Form CRS.

Web Site Development by: Goodwood Consulting

You are now leaving the Crawford Investment Counsel website and accessing the

Crawford Investment Funds website.

You are now leaving theCrawford Investment Funds website

and accessing the Crawford Investment Counsel website.

To help us personalize the site to your needs,

please select one of the following that best describes you.

You are now entering the area of the Crawford Investment Counsel website

that is for Consultant & Investment Professional Use Only.

You are now leaving the Crawford Investment Funds website and accessing the

Ultimus Fund Solutions website.

You are now entering the area of the Crawford Investment Counsel website

that is for Endowment & Foundation Use Only.