.jpeg)

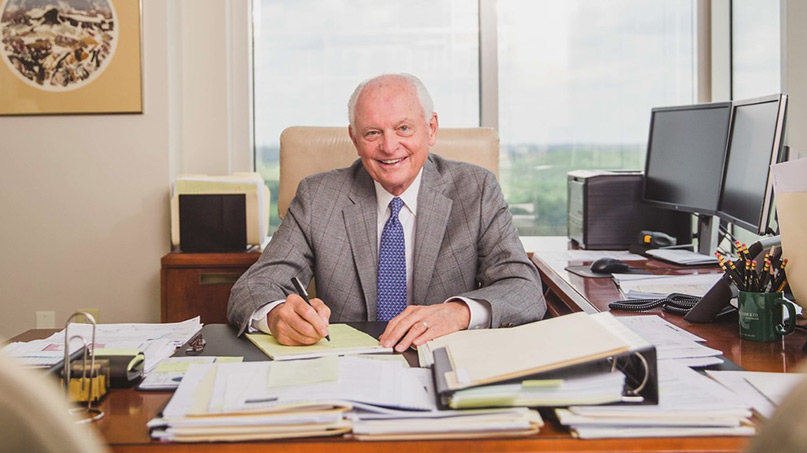

Crawford investment Counsel, Inc. was founded in 1980 by John H Crawford, III. The firm was founded on two operating principles that over forty years later continue to be the driving force for the firm: 1) invest in a conservative manner, and 2) provide clients with a high level of individualized service. The consistent application of these operating principles has enabled the firm to grow and prosper over the years. Most importantly, the clients of the firm have benefited from the firm’s unswerving goal of always attempting to do what is in the client’s best interest.

Founded in 1980, we are 100% employee-owned with over $9 billion in assets under management. We have built a fully integrated investment management firm with multiple generations in place to continue running the organization on its founding principles. Our investment philosophy has been consistently applied since the firm’s inception. We maintain a high level of client retention and deliver attractive long-term investment returns. Key components of each strategy are the fulfillment of specific objectives, consistent income generation, risk management, and a high level of personalized service.

Our business philosophy is separate yet linked to our investment philosophy and is incorporated into our guiding principles. From a business standpoint, we always put the client first and hold ourselves to the highest ethical standards. Integrity is non-negotiable at Crawford Investment Counsel, Inc. This philosophy combined with a long-term approach and a preference for investing in high-quality securities has led to an extremely high level of client continuity. This measure of business success, along with the growth and development of our team, is what makes us most proud.

At Crawford Investment Counsel, Inc., being transparent, honest, and always putting our clients first is non-negotiable and guides every decision made by the firm. Our commitment to integrity extends to underwriting every single investment decision to the absolute best of our ability, hiring only the best talent and reinvesting back into the business to proactively address our clients’ needs. Integrity also incorporates an honest assessment of what is working, what mistakes have been made, and being realistic about expectations and where value can be added.

We seek long-term relationships with our clients, and we value long-term relationships with our employees. We are proud to provide our clients with professional expertise from the same dedicated individuals year after year. As a family-owned firm, we have transitioned to a second generation of Crawford leadership, further extending our commitment to consistency. Our formula for continuity is differentiated and is consistent with everything we do.

Our investment philosophy focuses on total investment return, income production and risk management via high-quality investments. We seek to invest in consistent businesses through a consistently applied and disciplined research process in order to meet the goals and objectives of our investors.

Our goal is to respond to the needs of our clients in a manner that expresses our appreciation and respect for them. We do this by providing individualized, personal service from exceptional professionals who are committed to consistency, stability, responsiveness, and accurate reporting. Our client retention record is superb and it reflects our commitment to the highest level of service.

We take client confidentiality very seriously and value our clients’ privacy. We invest in safeguards to keep information confidential and adhere to a strict privacy policy.

Our goal is to be sure we are always acting in the best interest of our clients. Being independent allows us to work towards the ultimate goals of our clients and is simply the single best way to ensure the continued alignment of the interests of our firm and our investors.

600 Galleria Parkway

Suite 1650

Atlanta, Georgia 30339

Main: 770.859.0045

Fax: 770.859.0049

Email: info@crawfordinvestment.com

Copyright © 2025 | Crawford Investment Counsel, Inc. | All Rights Reserved.

Crawford Investment Counsel, Inc. (“Crawford”) is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Crawford Investment Counsel, including our investment strategies, fees and objectives, can be found in our Form ADV Part 2A and our Form CRS.

Web Site Development by: Goodwood Consulting

You are now leaving the Crawford Investment Counsel website and accessing the

Crawford Investment Funds website.

You are now leaving theCrawford Investment Funds website

and accessing the Crawford Investment Counsel website.

To help us personalize the site to your needs,

please select one of the following that best describes you.

You are now entering the area of the Crawford Investment Counsel website

that is for Consultant & Investment Professional Use Only.

You are now leaving the Crawford Investment Funds website and accessing the

Ultimus Fund Solutions website.

You are now entering the area of the Crawford Investment Counsel website

that is for Endowment & Foundation Use Only.